Your accounting team For total peace of mind.

We help small business owners like you save time and money doing your bookkeeping and tax prep package by providing dedicated experts so you can focus on growing your business.

It is free for you

What you get

Your all-in-one accounting partner

Professional Services

You started your firm because you’re passionate about serving your customers—not because you’re an expert at accounting. Good news: we are those experts.

Human Touch

Real humans. Perfect books. Your team of bookkeeping experts review your transactions and prepare financial statements every month.

CFO Service

Need advanced finance support? We have your back. Get the expert CFO support for your business needs, from building budgets to fundraising preparation.

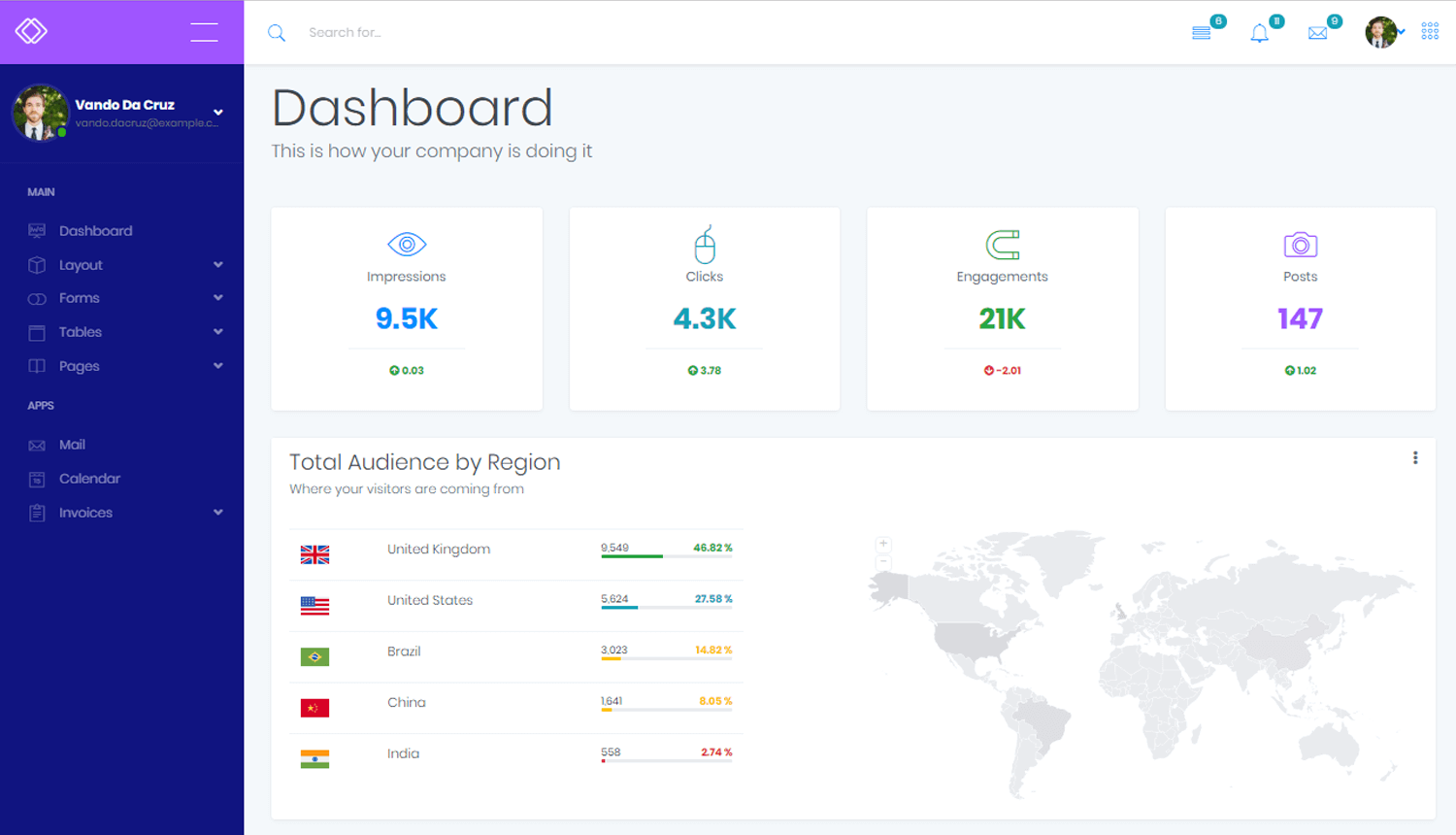

Focus on growing your business, not bookkeeping

BookieBliss gives you dedicated bookkeeping experts ensuring accurate and up-to-date books. With us, you can focus on growing your business while we take care of your finances.

Accurate BooksStart with BookieBliss

We deliver monthly P&L, Balance Sheet, and Statement of Cash Flow reports that offer insight into your company’s financial health and enable you to make informed decisions. Plus stay up to date with real time account data directly in QuickBooks.

BookieBliss Services are great for

Anyone who is looking for trusted accounting partner

Let's do business

What BookieBliss offers

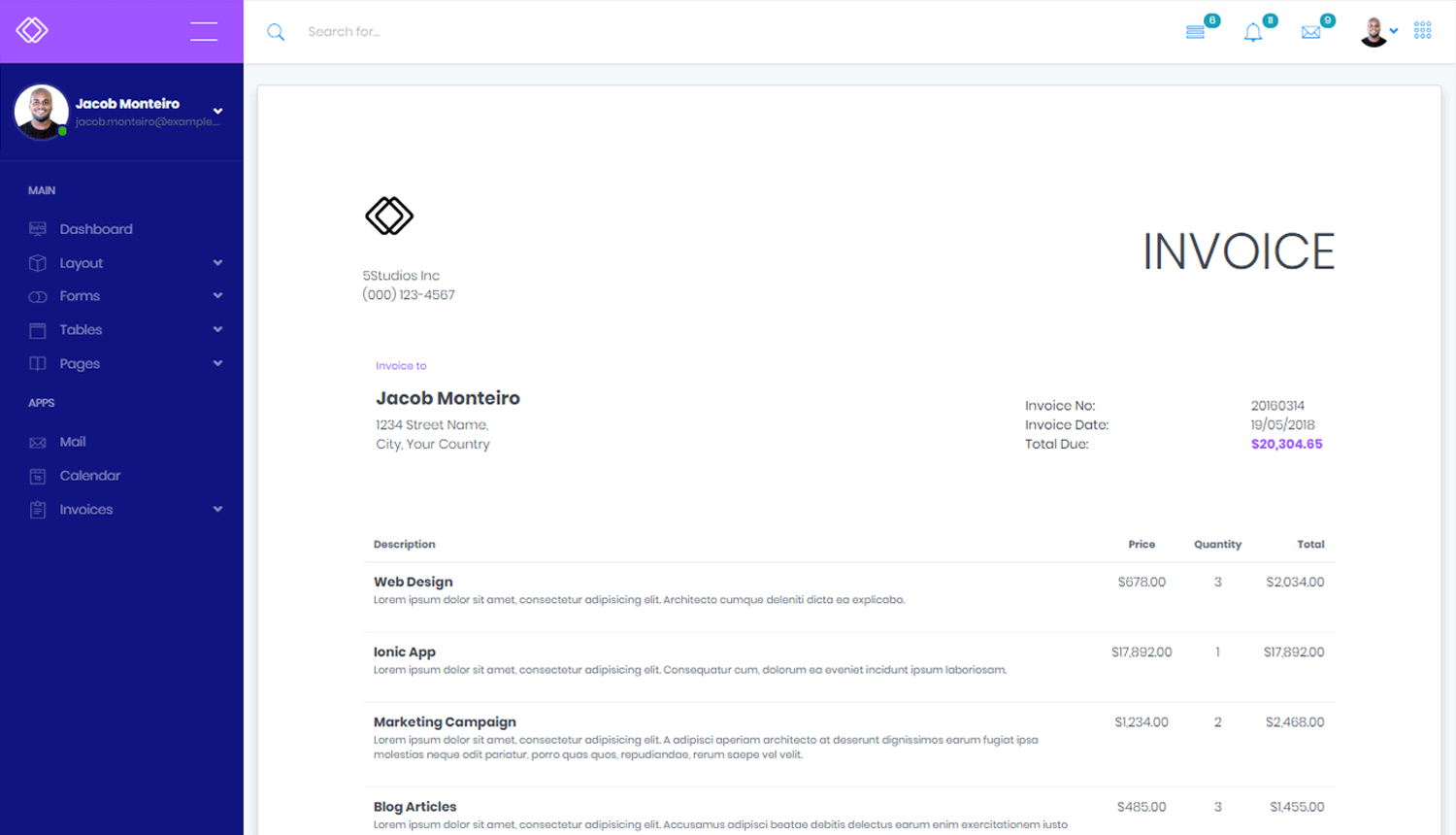

Track your finances in real-time

- On demand financials on your fingertips

- Ditch DIY accounting software and spreadsheets for expert bookkeeping on QuickBooks

- Track all your income and expenses to make real-time business decisions

Make Tax Season a Joy

- Accurate and up-to-date books ready for tax-filing

- Get a 360° financial view with P&L, balance sheets, 1099 reporting and more

- File on time with confidence and maximize your tax returns

Grow your business

- You focus on your business while the experts go the tedious work

- Expert advice on how to setup for invoice payments and Payroll systems

Special Projects

- We are experts at complex clean-up items spanning thousands of transactions

- We can go back years to help you organize your books for any taxes or audits